The CommBank Low Rate Credit Card is perfect for those wanting to save money. It’s designed for people who value financial efficiency. With low interest rates, it helps you save a lot of money.

By using this card wisely, you can stand out in a crowded market. Plus, it offers great cashback offers. This makes it a smart pick for daily expenses.

Anúncios

Understanding the CommBank Low Rate Credit Card

The CommBank Low Rate Credit Card is great for those who want lower interest rates. It’s perfect for people who often have a balance. This makes it a smart choice for managing money.

The card is easy to use, which is good for beginners. It’s all about being clear and simple. This helps new users get the hang of it quickly.

This card is designed for those who want to save money on borrowing. It’s perfect for anyone watching their budget closely. It helps keep costs down.

But, there’s a catch. You can only apply for this card if you haven’t had a low-rate card in 18 months. This rule makes sure the card stays special for new customers.

Key Features of the CommBank Low Rate Credit Card

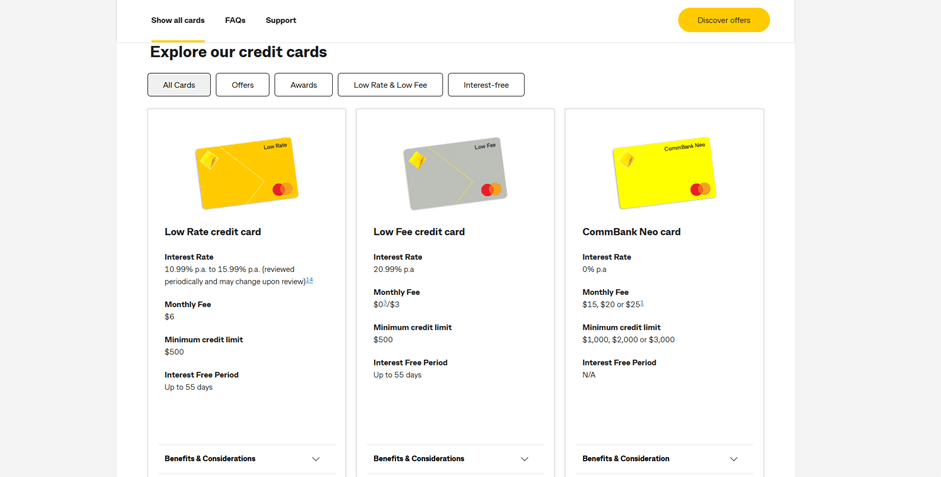

The CommBank Low Rate Credit Card is great for those who want to cut down on interest costs. It offers a low interest rate, ranging from 10.99% to 15.99% per year. This rate is based on how likely you are to pay back on time.

This card also comes with useful insurance perks. You get protection for your purchases and extended warranties, all thanks to Cover-More Insurance Services Pty Ltd. These benefits add a lot of value, making you feel secure when you shop.

Another plus is the card’s flexible credit limits. These are set to suit different needs, helping you manage your spending wisely. It’s all about keeping your finances in check and using credit responsibly.

Low fee

Benefits of Low Interest Rates

The CommBank Low Rate Credit Card brings many benefits of low interest rates. These rates help save a lot on interest payments. This makes managing finances easier and more effective.

With lower interest rates, you can save money for other important things. This freedom lets you plan for the future or cover daily expenses better.

Using a credit card with low interest rates is smart. It helps you manage credit well and improves your financial health. This leads to a more stable financial future for Australians.

Cashback Offers and Rewards

The CommBank Low Rate Credit Card offers great cashback deals. Cardholders earn cash back by spending $500 or more on eligible purchases each month. This can help improve your budgeting over time.

Over six months, you can get a total cashback of $450. This makes it a good choice for those who want to use their credit card wisely.

Cashback Mechanics

To get cashback, you need to spend at least $500 on eligible transactions. This excludes cash advances and refunds. Once you meet this, the cashback is added to your account within 90 days.

Maximising Your Rewards

To get the most out of the CommBank cashback offers, plan carefully. Here are some tips to help:

- Always track your spending to ensure you reach the $500 threshold.

- Focus on eligible purchases to avoid disqualifying your cashback.

- Consider using your card for routine expenses that fit within the cashback criteria.

By following these tips, you can make the most of the rewards program. Enjoy the financial benefits it offers.

Eligibility Criteria for Application

If you’re interested in the CommBank Low Rate Credit Card, first check if you qualify. There are certain criteria you need to meet. Knowing these makes the application process easier.

Who Can Apply?

To get the CommBank Low Rate Credit Card, you must meet these conditions:

- Applicants must be over 18 years of age.

- Individuals should not have held an activated low-rate or low-fee credit card in the past 18 months.

- Application acceptance is subject to credit approval, meant to assess financial capability.

This process helps the bank lend responsibly. It ensures applicants are financially stable and helps more people get credit.

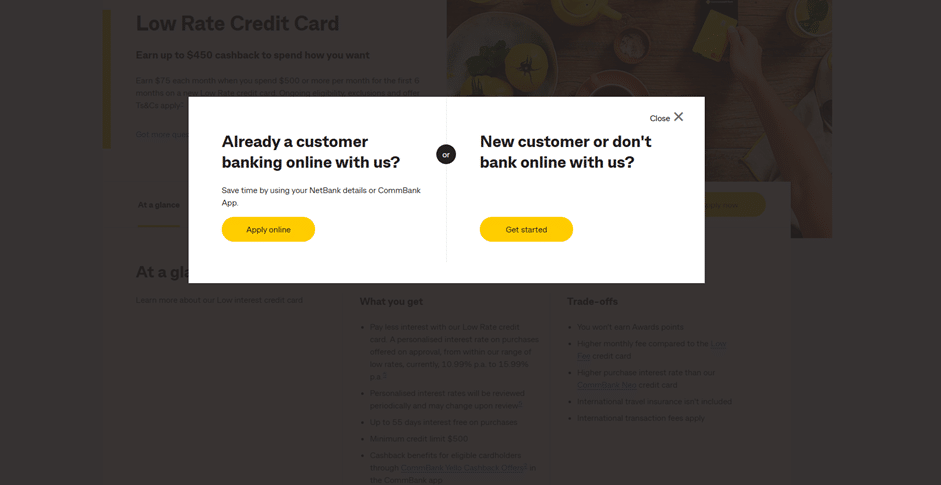

Step-by-Step: How to Apply for the CommBank Low Rate Credit Card

Applying for the CommBank Low Rate Credit Card is usually quickest through CommBank’s secure online system. Below is a simple walkthrough of the process from start to finish.

Step 1: Go to the Official CommBank Website

Start by visiting the official CommBank website and locating the Low Rate Credit Card page.

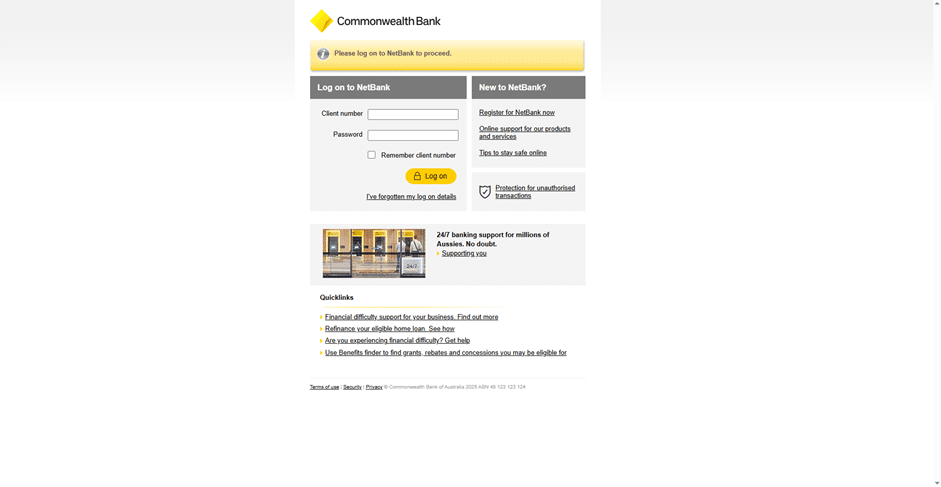

If you already bank with CommBank, you can also begin through NetBank or the CommBank App, which may speed things up by automatically filling in some of your details.

Step 2: Choose Your Preferred Credit Limit

During the application, you’ll be asked to select the credit limit you want.

For the CommBank Low Rate Credit Card, the minimum credit limit is typically $500.

Keep in mind that even if you request a certain amount, the final credit limit you receive will depend on CommBank’s lending assessment and your financial situation.

Step 3: Fill Out the Online Application Form

The digital application is divided into secure sections, and you’ll be guided through each one.

You’ll usually need to provide:

Personal information: full name, date of birth, address, residency status, and contact details.

Work and income details: employer information, job status, annual income, and any additional income sources.

Expenses and debts: living expenses and any current liabilities, such as home loans, car loans, personal loans, or other credit cards.

This part is especially important because banks in Australia must follow responsible lending rules, meaning your financial details must be accurate and complete.

Step 4: Review Terms and Give Consent

Before you submit, CommBank will show you the main terms and conditions, including key fees and interest rates.

You will also need to provide consent for CommBank to perform a credit check through credit reporting agencies as part of the approval process.

Step 5: Submit Your Application and Complete Verification (If Required)

Once everything is complete, submit your application through the secure portal.

Depending on your situation, you may be asked to upload documents such as:

Payslips

Bank statements

Other income verification documents

This step is more common for new customers or applications where income needs extra confirmation.

After submission, CommBank will assess your application and notify you of the outcome. In some cases, you may receive an instant or near-instant response, especially if you are already a CommBank customer.

Step 6: Receive, Activate, and Manage Your Card

If approved, your CommBank Low Rate Credit Card will be sent to your Australian mailing address.

Before you can use it, you’ll need to activate the card. This can usually be done through:

The CommBank App

NetBank

Phone activation (if needed)

Once activated, you can manage the card directly from the app, including tracking spending, setting up AutoPay for repayments, and using security tools such as transaction controls and card locking features.

Managing Your Credit Card Responsibly

Managing your credit card well is key to a stable financial future. It’s important to use your card in a way that fits your financial goals. Good budgeting is a big part of this.

Creating a monthly budget helps you keep track of your spending. By spotting where you spend too much, you can make smarter choices. Always paying off your balance each month is also key. It helps you avoid extra interest and keeps your card benefits intact.

Being disciplined with your credit card is essential. Paying on time keeps your credit score high and builds good financial habits. Knowing the costs of cash advances and the interest they attract helps you use your card wisely. This supports your overall financial health.

Comparing with Other Credit Card Options

When looking for the best credit card, comparing is key. The CommBank Low Rate Credit Card is a strong contender against many Australian cards. It shines with its low interest rates, making it a top choice for many.

Credit cards come with various perks, like cashback and rewards. While the CommBank card has low rates, others might offer better rewards for frequent shoppers. For example, cards with travel insurance or extra points on certain purchases could be more appealing.

It’s also important to check the fees. Different cards have different annual fees and transaction charges. Knowing these can help you choose the card that fits your spending and financial goals best.

- Interest Rates: Compare the ongoing rates of different cards.

- Cashback Opportunities: Evaluate potential earnings through spending.

- Additional Benefits: Assess if other cards offer travel perks or rewards points.

- Fees: Consider annual fees and any hidden charges.

Interest Rates Explained

Credit card interest rates can greatly affect your money choices. The CommBank Low Rate Credit Card starts at 13.99% for those switching. This fixed rate is for many types of transactions, making it clear how interest builds up.

Interest rates change based on your risk and the market. Knowing how interest affects you is key for budgeting. Different transactions have different rates. For example, buying things usually costs less than getting cash advances, which can be more expensive if not managed right.

Understanding these details helps you manage your money better. It helps with long-term planning and making smart repayment choices.

Common Fees Associated with the CommBank Low Rate Credit Card

Knowing the fees for CommBank credit card is key to managing your money well. The card has low interest rates, but there are costs to watch out for. For example, you might face a $300 charge for cash interest on certain balances.

There are also fees based on how you use the card. If you don’t spend enough, you might pay a flat monthly fee. Knowing these costs helps you understand what to expect. Always check the “Credit Card Conditions of Use” for all the fees you might face.

Conclusion

The CommBank Low Rate Credit Card is a great choice for managing your money well. It has low interest rates and cashback deals. This makes it perfect for saving money while still using a credit card.

People who want to improve their finances will find this card useful. The low interest rates can save you a lot of money. Plus, the cashback program rewards you for using the card wisely.

Before applying, think about what you want to achieve financially. The CommBank Low Rate Credit Card can help you manage your money better. It’s a smart choice for keeping your finances stable and growing over time.

FAQ

What is the interest rate range on the CommBank Low Rate Credit Card?

Can I receive cashback with this credit card?

What are the eligibility requirements for applying?

How can I manage my credit card responsibly?

What fees should I be aware of with the CommBank Low Rate Credit Card?

How does the CommBank Low Rate Credit Card compare to other credit card options?

How long does it take to receive the cashback?

What transactions incur interest charges?

Conteúdo criado com auxílio de Inteligência Artificial