The Wells Fargo Active Cash card is a straightforward cash-back credit card that offers an unlimited 2% cash-back rate on purchases. This opening section shows U.S. readers how to request card online so they can start earning rewards quickly and manage their account through Wells Fargo Online or the Wells Fargo Mobile app.

Applying online brings clear benefits: speed, convenience, and immediate access to current offers such as welcome bonuses or promotional APRs shown on wellsfargo.com. When you apply, the Active Cash online application will ask for personal, income, and housing details, so have accurate information ready to avoid delays.

Anúncios

Eligibility and specific offers can vary by applicant. To apply Wells Fargo Active Cash you need to be a U.S. resident or otherwise meet Wells Fargo’s qualified applicant criteria. Final approval depends on credit review and underwriting policies.

For security, always submit a Wells Fargo credit card request through official channels—wellsfargo.com or the Wells Fargo app—to reduce the risk of scams and phishing attempts.

Wells Fargo Active Cash

Key Takeaways

- Wells Fargo Active Cash provides an easy 2% unlimited cash-back structure.

- Request card online for faster processing and access to current offers.

- Have personal, income, and housing information ready for the Active Cash online application.

- Approval depends on credit review and Wells Fargo underwriting.

- Use wellsfargo.com or the Wells Fargo Mobile app to apply Wells Fargo Active Cash safely.

Step-by-Step Guide: How to Apply for the Wells Fargo Active Cash® Credit Card

Applying for the Wells Fargo Active Cash® Card is straightforward when you follow each step carefully. This guide explains how to complete the process easily and securely.

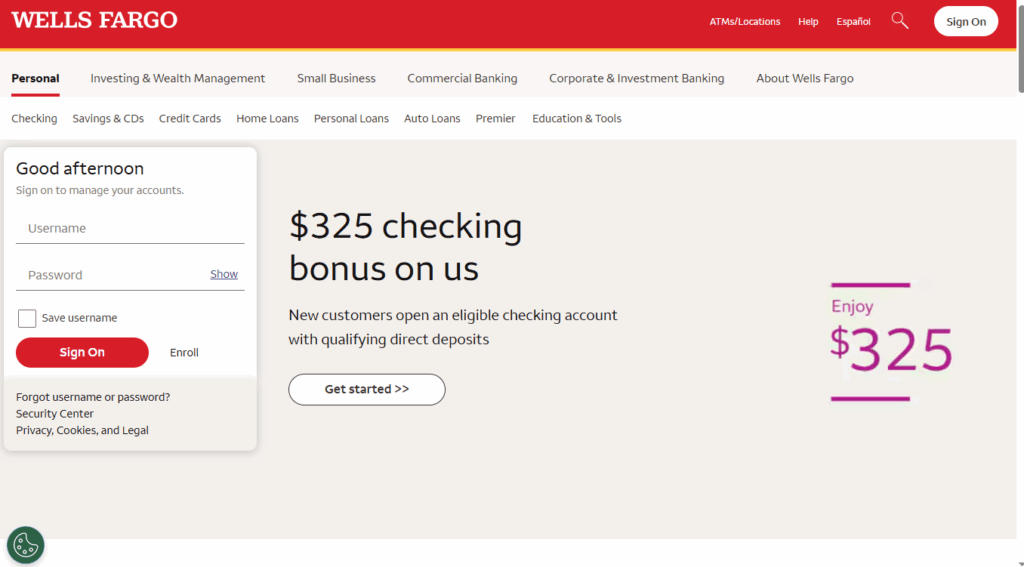

1. Visit the Wells Fargo Official Website

Start by accessing https://www.wellsfargo.com/.

On the homepage, you’ll find the full range of Wells Fargo services, including credit cards, checking and savings accounts, loans, and investment options.

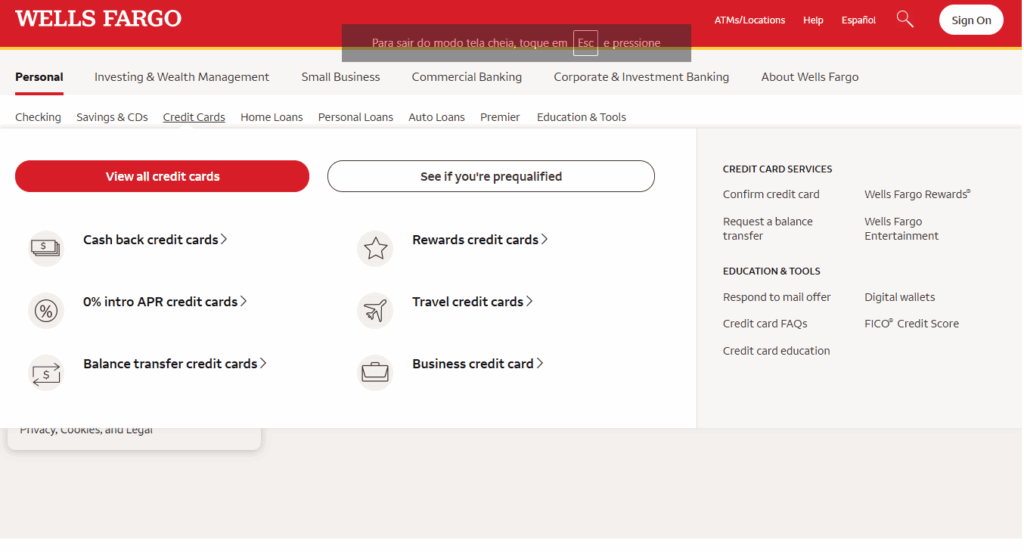

2. Go to the Credit Cards Section

At the top of the page, open the main menu and click on “Credit Cards.”

Then select the “Cash Back Credit Cards” option from the dropdown.

This section displays all Wells Fargo cashback cards available for consumers.

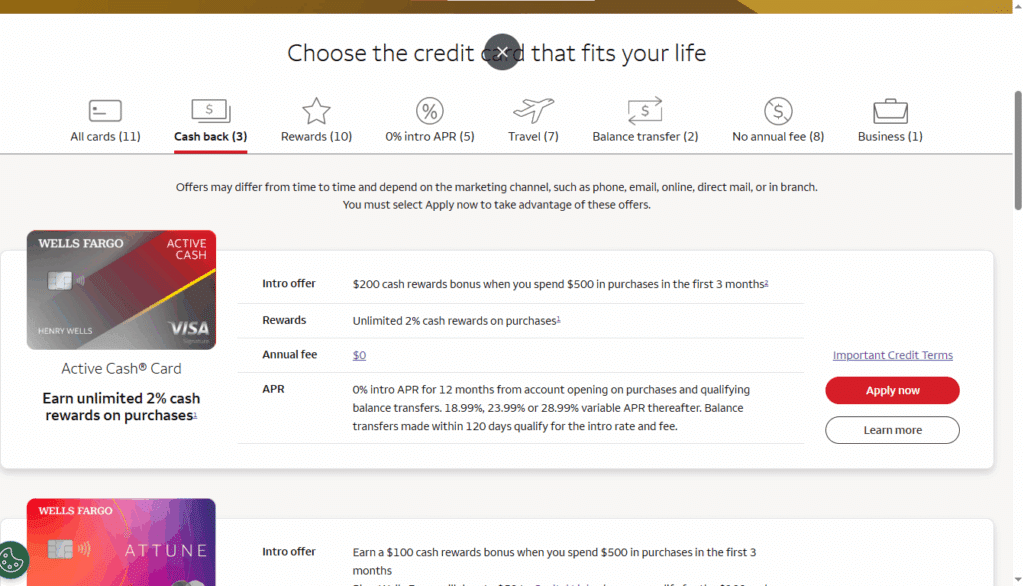

3. Choose the Wells Fargo Active Cash® Card

Once you’re on the cashback cards page, you’ll see several options such as the Attune® Card and Signify Business Cash® Card.

Use the filters at the top of the page — like Cash Back, Rewards, No Annual Fee, or 0% Intro APR — to narrow down your choices.

Locate the Wells Fargo Active Cash® Card, then click the blue “Apply Now” button to start the process.

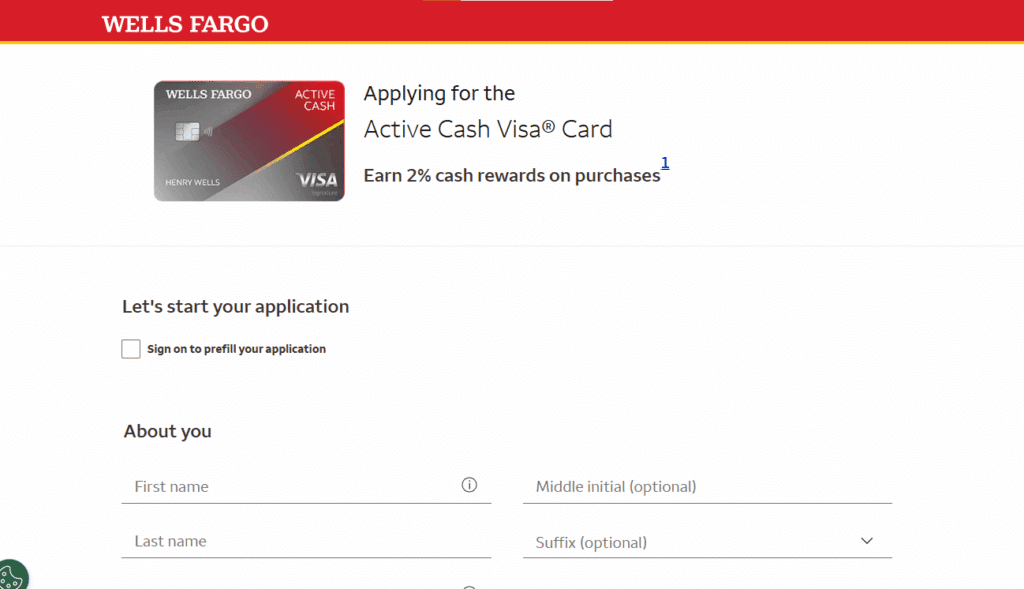

4. Complete the Online Application Form

You’ll be directed to a secure form where you’ll need to fill in your details:

- Personal and Contact Information: Full name, address, phone number, and email.

- Identity Verification: Social Security Number (SSN) or ITIN, and date of birth.

- Financial Details: Employment status, annual income, and monthly housing payments.

After submitting your application, Wells Fargo will perform a credit review. If approved, your Active Cash® Card will be mailed to you within 7–10 business days.

Alternative Application Process

- Access the Credit Card Application Portal

Go to the official Wells Fargo credit card page and click “Apply Now.” This ensures you get the most recent offers and updated terms. - Check Eligibility Requirements

Before applying, make sure you meet the following:- At least 18 years old.

- U.S. resident with a valid address.

- Possess a Social Security Number (SSN) or ITIN.

- Have a good to excellent credit score (typically 700+).

- Provide verifiable income information for approval.

- Fill Out the Form Accurately

Input your personal, financial, and identification details as requested.

Double-check all fields before proceeding to avoid errors that may delay approval. - Submit and Wait for Review

After reviewing your form, click “Submit.” Wells Fargo will process your request, often giving an instant decision. In some cases, additional verification may take a few days. - Approval and Activation

If approved, your card will arrive within one to two weeks.

Activate it via the Wells Fargo app, online banking, or by phone. Once activated, you can start earning unlimited 2% cash back immediately.

Main Benefits of the Wells Fargo Active Cash® Card

- Unlimited 2% Cash Back: Earn 2% on every purchase — no categories or rotating limits.

- $200 Bonus Offer: Earn after spending $500 within the first 3 months.

- 0% Intro APR for 12 Months: Applies to both purchases and balance transfers.

- Cell Phone Protection: Coverage up to $600 against theft or damage (with a $25 deductible).

- Auto Rental Collision Coverage: Protection for eligible rental car damages.

- Travel and Emergency Assistance: Access global support during trips.

- Zero Liability Protection: Safeguards you from unauthorized transactions.

As a Visa Signature® card, it also provides concierge services and access to the Luxury Hotel Collection, offering exclusive discounts and experiences for cardholders.

Final Thoughts

The Wells Fargo Active Cash® Card is an excellent choice for those who value simplicity and consistent rewards.

By following this step-by-step guide, you can complete your application easily and begin enjoying unlimited cash back, comprehensive protections, and premium Visa Signature® benefits.

Wells Fargo

Wells Fargo Active Cash – How to request your card online

Requesting the Wells Fargo Active Cash card online is a simple, guided process. Follow clear online application steps to move from start to finish without leaving your home. The bank’s site and mobile app walk you through each field, show required disclosures, and use secure HTTPS for data protection.

Overview of the online request process

Begin at wellsfargo.com or open the Wells Fargo mobile app and find the Active Cash product page. Click “Apply Now” and complete the form with personal and financial details. Expect prompts for income, housing, and identification data.

Before submission, you will review account terms and accept disclosures with a digital signature. The portal may ask for extra verification, such as a one-time passcode or document upload, to confirm identity.

Why requesting online is faster than mail or phone

Online filing trims delays by validating entries as you type. Instant error checks lower the chance of missing details that slow manual processing. Automated identity and credit checks run right away, so you may get an instant decision.

Digital signatures and secure uploads speed processing compared with mailed forms or phone calls that need manual handling. These apply online benefits help most applicants finish sooner and track progress faster.

What to expect after submitting your request

After submission you might receive an immediate approval or a decision within minutes. If the application needs more review, Wells Fargo could place it on hold and request documentation such as proof of income or photo ID.

Approved applicants get confirmation emails and can follow the Wells Fargo online card request timeline through their online account. If a decision is declined, the bank typically provides a reason code and options to request reconsideration or review credit reports.

Who is eligible to request the Wells Fargo Active Cash card

To request the Wells Fargo Active Cash card, you must meet a few baseline requirements. Applicants should be U.S. residents with a valid Social Security number or ITIN and a verifiable income. Age rules vary by state, so expect a minimum of 18 years old and 21 in states where creditors require a higher age for credit obligations.

Applicants who have recent bankruptcies, unresolved collections, or other disqualifying financial events may face denial under Wells Fargo underwriting rules. Keep documentation ready to verify income, address, and identity when you apply online to speed up the process.

How credit score and history affect approval odds

Wells Fargo evaluates credit bureau data alongside internal credit models. Cards with rewards, like Active Cash, tend to favor applicants with good to excellent scores. High credit utilization, recent delinquencies, collections, or many recent inquiries can reduce approval odds.

Debt-to-income and existing balances on other Wells Fargo accounts influence decisions. Meeting typical credit score requirements increases the chance of approval, but solid account history and low utilization matter just as much.

Special eligibility considerations for existing Wells Fargo customers

Current Wells Fargo customers may see tailored prequalified or preapproved offers through Wells Fargo Online or secure messages. Account history, such as steady deposits and a good standing on checking or savings accounts, can improve underwriting outcomes.

Existing customers enjoy Wells Fargo customer benefits that sometimes include relationship pricing or faster identity checks. Authorized user options are available, yet the primary cardholder keeps legal responsibility for charges.

| Eligibility Factor | What Wells Fargo Looks For | Effect on Approval Odds |

|---|---|---|

| Residency and ID | U.S. address, SSN or ITIN, valid photo ID | Required; missing items block approval |

| Age | 18+ in most states; 21+ where required | Must meet state minimums to proceed |

| Income | Verifiable income or household support | Higher income helps; none may cause denial |

| Credit history | Credit bureau records, utilization, delinquencies | Key factor; aligns with credit score requirements |

| Existing Wells Fargo relationship | Checking/savings history, account standing | Positive history can increase approval odds via Wells Fargo customer benefits |

| Recent credit actions | New accounts, inquiries, recent denials | Multiple inquiries lower chances |

Preparing to request your card online: documents and information needed

Before you start the Wells Fargo Active Cash application, gather the right paperwork and facts. Having these items ready speeds the process and reduces verification holds.

Personal identification details to have ready

Provide your full legal name, date of birth, and Social Security number or ITIN. Keep a government-issued ID, such as a driver’s license or state ID, available in case Wells Fargo requests a number for verification. Make sure the name and SSN match credit reports to avoid delays.

Income and employment information

Have your current employer’s name, job title, gross annual income or household income, and length of employment on hand. If you are self-employed, prepare recent income figures or business revenue estimates. Wells Fargo application documents may include requests for proof of income like pay stubs or tax returns if extra verification is needed.

Contact and housing information

Enter your current residential address and mailing address if different. Include your monthly housing payment, phone number, and a secure email address that you check often. This contact info helps Wells Fargo send status updates and reach you for identity verification calls or texts.

Consider listing monthly debt obligations, recent prior addresses if you moved, and housing tenure. Existing Wells Fargo customers should have online access credentials ready to link accounts and speed the process. Knowing what info needed to apply reduces friction and gives you confidence during submission.

When preparing documents for credit card application, organizing them into a single folder or scanned PDF streamlines uploading. Clear, accurate Wells Fargo application documents help the bank verify identity and income more quickly.

Step-by-step guide to requesting the card on Wells Fargo’s website

Use this short guide to complete the Active Cash application with confidence. Follow each step, double-check your entries, and save the confirmation after you submit. This will help prevent delays and make the process smoother when you learn how to apply Wells Fargo Active Cash online.

Navigating to the application

Open wellsfargo.com or the Wells Fargo Mobile app and go to the Credit Cards section. Look for the Active Cash card listing or use the site search. Click the Apply Now button shown with current offers and rewards. If you are logged into Wells Fargo Online, check your dashboard for prequalified offers before you start.

Filling out the form

Enter your full legal name, Social Security number or ITIN, and date of birth exactly as shown on your ID. Provide contact details, employment status, and annual income. Include housing payments and monthly obligations when prompted. If adding an authorized user or joint applicant, supply their full name and SSN when requested. Accuracy matters to avoid identity verification holds during the Active Cash application steps.

Reviewing terms and submitting

Read the cardmember agreement, APR disclosures, fees, and rewards details before you accept. Note any promotional terms such as intro APR or bonus spending requirements. Electronically acknowledge the disclosures and submit the form. Save or print the confirmation page and record any reference number you receive. Wells Fargo will contact you by email or secure message about approval, additional documentation, or next steps after you apply Wells Fargo credit card.

| Step | What to do | Why it matters |

|---|---|---|

| 1. Locate card | Visit wellsfargo.com or open the app and select Active Cash | Find current offers and the Apply Now button quickly |

| 2. Enter ID details | Type name, SSN/ITIN, DOB and contact info | Matches identity records to speed approval |

| 3. Provide income | Report employment status and annual income | Determines credit line and underwriting decisions |

| 4. Confirm housing | List rent or mortgage payment amounts | Helps assess debt-to-income and approval odds |

| 5. Review terms | Read disclosures, APRs, fees and reward rules | Prevents surprises after you apply Wells Fargo credit card |

| 6. Submit & save | Accept disclosures, submit application, save confirmation | Proof of submission and reference for follow-up |

How to request a replacement or additional Wells Fargo Active Cash card online

If your Active Cash card is lost, stolen, or you need extra cards for family members, Wells Fargo makes online requests simple and secure. Log into Wells Fargo Online or use the mobile app to start. Below are clear steps and practical tips to help you report a missing card, add a user, or update mailing details before the new card ships.

Requesting a replacement for lost or stolen cards

Sign in to your account and choose the credit card account for the Active Cash card. Look for the option to report a lost or stolen card or to replace card. Wells Fargo will cancel the compromised card to prevent misuse and issue a replacement.

Watch your transactions closely after you report the card. If you see unauthorized charges, use the dispute tools in online banking or call customer service right away. In some cases, Wells Fargo may expedite shipping if fraud is suspected or if you have urgent need.

Ordering additional authorized user cards

The primary account holder can add authorized users through Wells Fargo Online. Provide the authorized user’s full name and date of birth when prompted. Social Security numbers are not always required, but supplying it can help with credit reporting for that user.

Authorized user cards earn rewards on purchases. Keep in mind the primary cardholder remains legally responsible for all charges made on any authorized user card. Each additional card usually ships separately and must be activated when it arrives.

Updating delivery address before card issuance

If your address changes after approval but before the card is produced, contact Wells Fargo right away via secure message or phone. Prompt action can help update the mailing address and prevent misdelivery.

If the card has already entered production, rerouting may not be possible. In that case, speak with customer support to arrange the next steps and protect your account. For existing accounts, keep the primary address current to avoid delays or delivery issues.

| Request Type | Where to Start | Required Info | What to Expect |

|---|---|---|---|

| Replace lost or stolen card | Wells Fargo Online or mobile app | Account login, confirmation of identity | Compromised card canceled, replacement issued, possible expedited shipping |

| Add authorized user | Wells Fargo Online — manage card settings | Authorized user full name, DOB; SSN optional | New card for user, earns rewards, primary holder liable for charges |

| Update mailing address before issuance | Secure message or customer service phone | Account details, new mailing address | Address updated if card not yet produced; otherwise support will advise next steps |

Security and privacy when requesting your card online

Requesting a Wells Fargo Active Cash card online should feel safe and straightforward. Wells Fargo uses secure HTTPS connections, multi-factor authentication for online accounts, encryption for stored data, and continuous fraud monitoring to guard applications and accounts. The bank may run identity checks using credit bureau data and trusted third-party services. For sensitive conversations, use secure messages in Wells Fargo Online rather than regular email.

Wells Fargo’s online safeguards

Wells Fargo online security includes layered protections that start the moment you load the application page. Logins often require a password plus a one-time code sent to your phone or authenticator app. Transaction and account activity are monitored for unusual patterns that can trigger alerts or holds. These measures reduce the risk of fraudulent account openings or unauthorized access.

Practical tips to protect personal data

Apply only on wellsfargo.com or the official Wells Fargo mobile app when you request a card. Public Wi-Fi can expose data, so use a private network or a mobile hotspot when you submit sensitive information. Create a strong, unique password and enable multifactor authentication for your online banking. Keep your device operating system and antivirus software current.

Monitor email and account alerts for suspicious sign-ins or unfamiliar activity. If you need to share documents, prefer the bank’s secure messaging feature instead of regular email. These steps help protect personal info applying credit card requests and lower the chance of identity theft.

How to recognize and avoid scams

Phishing attempts often mimic Wells Fargo branding but come from non-official domains and ask for full Social Security numbers or passwords via email or text. Legitimate messages from the bank will not request full SSNs or your login credentials in an unsolicited message. Be cautious of urgent-sounding calls or texts that pressure you to provide personal or financial details.

If you suspect a fake message, report it to the bank and forward phishing emails to [email protected] following Wells Fargo’s reporting guidance. These actions help you avoid phishing Wells Fargo attempts and protect your account from fraud.

Processing times and shipping details for online card requests

After you submit an online application, expect a quick decision for many applicants. Some receive an instant result, while others see a short review period that can extend the approval time Wells Fargo requires.

Identity checks or requests for extra paperwork can lengthen the timeline. If Wells Fargo asks for documents, respond promptly to avoid added delays.

Once approved, Wells Fargo typically moves to card production and mailing. Standard delivery often takes about seven to ten business days, though location and postal service issues can affect the Wells Fargo card shipping time.

In some cases, you may get a temporary card number for use with digital wallets until the physical card arrives. This helps keep you active while waiting for standard mail delivery.

Expedited card delivery is sometimes available, particularly for replacements or special service requests. Policies and fees vary, so contact Wells Fargo customer service to confirm availability and any charges for expedited card delivery.

Below is a quick reference comparing typical timelines and options.

| Step | Typical Timeframe | Notes |

|---|---|---|

| Initial decision | Instant to 3 business days | Many applicants get instant decisions; others require brief review |

| Approval time Wells Fargo (when under review) | 2–5 business days | Depends on identity verification and documentation requests |

| Card production | 1–3 business days after approval | Production begins once approval and address verification complete |

| Wells Fargo card shipping time (standard) | 7–10 business days | Delivery may vary by postal service and distance |

| Expedited card delivery | 1–3 business days (when available) | May incur fees; contact customer service to request expedited shipping |

Troubleshooting common issues when requesting online

If your online application stalls or returns an error, start with simple checks. Confirm your internet connection and switch browsers if needed. Clear the cache or try a different device to see if the issue clears up.

Make sure every required field matches your official documents. Mismatched names, Social Security numbers, or addresses commonly trigger an application submission error Wells Fargo. Turn off autofill when it inserts odd formats for dates or phone numbers.

If the problem persists, use the Wells Fargo Mobile app to submit the request. You can also call the credit card application phone number listed on the site for immediate help.

What to do if the application won’t submit

Review the form for incomplete fields and incorrect formats. Check that your browser supports encryption and pop-ups for forms. Try pasting plain text into fields instead of formatted text from other apps.

When technical fixes don’t work, take a screenshot of the error message. That image helps Wells Fargo representatives diagnose the issue fast when you contact Wells Fargo customer support apply.

Resolving identity verification holds

Wells Fargo may place a hold to verify identity. Respond quickly to requests for documents such as pay stubs, tax returns, utility bills, or a government ID. Upload documents through the secure message center or follow the instructions you receive.

Discrepancies in name spelling, SSN digits, or address details are frequent causes of holds. Check your entries against your Social Security card and a recent credit report. Clear, matching data speeds resolution of identity verification Wells Fargo.

If you don’t hear back within the timeframe given, follow up through secure messaging or by phone to confirm receipt and next steps.

Contact channels for online application support

For non-urgent help, send a secure message through Wells Fargo Online or use the support feature in the Wells Fargo Mobile app. Keep your application date and any error text handy when you write.

For urgent matters, call the dedicated credit card phone number shown on wellsfargo.com. Report suspected fraud or account compromise to the fraud reporting line immediately. When you need real-time assistance with an application submission error Wells Fargo, speaking to an agent can save time.

Remember to mention any steps you’ve already tried and include screenshots if possible. That makes it easier for Wells Fargo customer support apply teams to identify the issue and guide you to completion.

Maximizing benefits after requesting and receiving the Active Cash card

When your Wells Fargo Active Cash card arrives, take a few quick steps to start using it and protect your account. Activating the card is simple through Wells Fargo Online, the Wells Fargo mobile app, or by phone. Enroll in online banking to view statements, track activity, and set alerts for payments and suspicious transactions.

Activating your card and setting up online banking

To activate Wells Fargo card, open the mobile app or sign into Wells Fargo Online and follow the activation prompts. If a temporary digital card number is provided after approval, add it to Apple Pay or Google Wallet for immediate use. Enable notifications and set up autopay to avoid missed payments.

Understanding cash-back rewards and redemption options

The Active Cash rewards program gives a flat cash-back rate on purchases, making earnings easy to track. Redeem rewards as statement credits, deposits to a Wells Fargo checking or savings account, gift cards, or checks based on the available options in the rewards portal. Check the portal for minimum redemption amounts and occasional bonus categories that boost returns.

Tips for using the card responsibly to build credit

Paying the full statement balance by the due date keeps interest from eroding the value of Active Cash rewards. Keep your credit utilization under 30% of your available credit to help your score rise over time. Use autopay to prevent late payments that hurt credit.

Monitor your credit reports at least once a year and dispute any errors quickly. Avoid multiple new credit applications in a short period to limit hard inquiries. Thoughtful, consistent use of this card can help you build credit with credit card while enjoying steady cash-back returns.

Comparing Wells Fargo Active Cash with other cash-back cards

Wells Fargo Active Cash offers a simple, flat-rate cash-back structure that appeals to cardholders who want steady rewards without fuss. To compare cash-back rewards, look at how a flat unlimited rate stacks up against cards that reward specific categories like groceries, gas, or travel.

Key perks that set Active Cash apart

The biggest strength is simplicity: an unlimited flat cash-back rate on purchases with no rotating categories to track. Integration with Wells Fargo checking and savings makes account management easy. The Wells Fargo mobile app and online tools help users redeem rewards quickly and monitor activity in one place.

When a different cash-back card might be a better fit

If most of your spending falls into a few high-return categories, a category-specific card can deliver higher value than a flat-rate card. Cards from Chase, American Express, and Citi often offer boosted rewards for groceries, dining, or travel. Frequent travelers may prefer travel-focused rewards that include transfer partners or travel credits.

How signup bonuses and APRs compare

Signup bonuses vary by issuer. Some cards offer larger welcome bonuses but require a higher minimum spend to earn them. Introductory APR promos are common on balance-transfer or new-purchase offers from other banks. When you compare cash-back rewards, factor in the bonus size, required spend, ongoing APR ranges, and any penalties.

Choosing between Wells Fargo Active Cash vs other cards depends on your habits and goals. If you want a no-fuss, always-on cash-back experience, Active Cash ranks high among the best cash-back cards for simplicity. If you chase higher returns in certain categories or value big travel perks, other cards may beat a flat-rate approach.

Make direct comparisons of welcome offers, annual fees, rewards rate, and APR before you apply. That way you can match the card to your spending pattern and avoid surprises later.

Conclusion

Applying to request Wells Fargo Active Cash online is a fast, secure way to get a simple cash-back card. Gather your personal details, income and housing information before you apply Active Cash card through wellsfargo.com or the Wells Fargo mobile app. Review the terms carefully, submit the application, and then await approval and card delivery.

For a smooth process, apply from a secure connection and make sure the information you provide matches your credit records. Have documents ready in case the bank requests identity verification. Once the card arrives, activate it promptly so you can start earning cash back on purchases.

Compare the flat-rate cash-back benefits to other cards to confirm the Active Cash fits your spending. Existing Wells Fargo customers should check prequalified offers in the online banking portal. For help with an application or to report an issue, use Wells Fargo’s official customer service channels.

FAQ

What is the Wells Fargo Active Cash card and why apply online?

What information will I need to complete the online application?

How does the online application process work step by step?

How long does it take to get a decision and receive the card?

Who is eligible to apply for the Active Cash card?

How do credit score and credit history affect my approval odds?

Are there special considerations for existing Wells Fargo customers?

What should I do if the online application won’t submit?

What happens if my application is placed on hold for identity verification?

How can I request a replacement or add an authorized user online?

Can I change my mailing address after approval but before the card ships?

What security measures protect my data during the online application?

How do I recognize phishing or scam attempts related to my application?

Are expedited shipping options available for the new card or a replacement?

What are the best practices for activating and using the card responsibly?

How do cash-back rewards work and how can I redeem them?

How does Active Cash compare with other cash-back cards?

Where can I get help if I encounter problems with my online application?

Conteúdo criado com auxílio de Inteligência Artificial